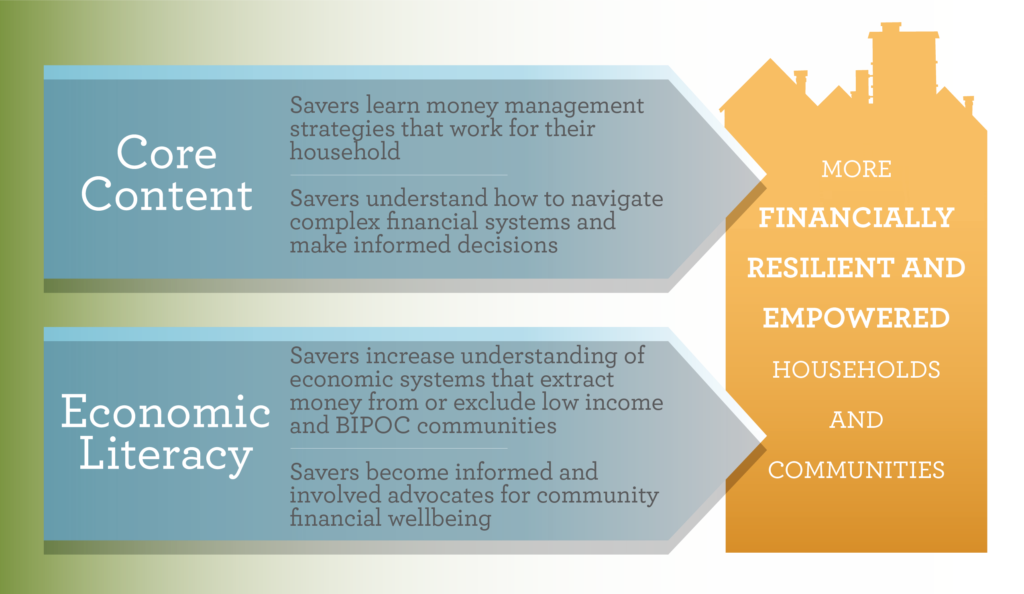

Economic literacy, in this context, is the identification and evaluation of economic legacies as they relate to personal finance, wealth, the economy, and political systems.

Imagine you are teaching someone to swim. Most likely you start off in a controlled environment like a shallow pool with clear visibility of the bottom and sides of the pool. You teach basic water safety, the mechanics of floating, how to stay calm in the water, how to exhale underwater, the beginning stroke and treading water. Teaching these steps is not unlike teaching basic financial education. These skills are essential to our success in the pool but they fail to acknowledge that swimming in a controlled environment is vastly different from swimming in a river where the swimmer has to contend with powerful currents and various obstacles.

Our financial lives occur not in a controlled pool, but a river where wage stagnation, tax policies, shifts in labor trends, and differential access to wealth building tools and credit make it harder for many people, particularly Black, Indigenous and People of Color, to successfully stay afloat. Teaching financial education without addressing economic literacy erroneously emphasizes that financial wellness depends solely on individual actions and fails to acknowledge pre-existing systemic economic and racial inequities that perpetuate severe income and wealth disparities.

A functioning democracy with an economy that works for everyone requires an informed and involved electorate. Solely teaching financial education without the broader historical economic context we live in reinforces the status quo. Understanding how past and present policy choices have created the current unjust economic systems enables participants to engage in the advocacy required to ensure long term financial security for themselves and their community.